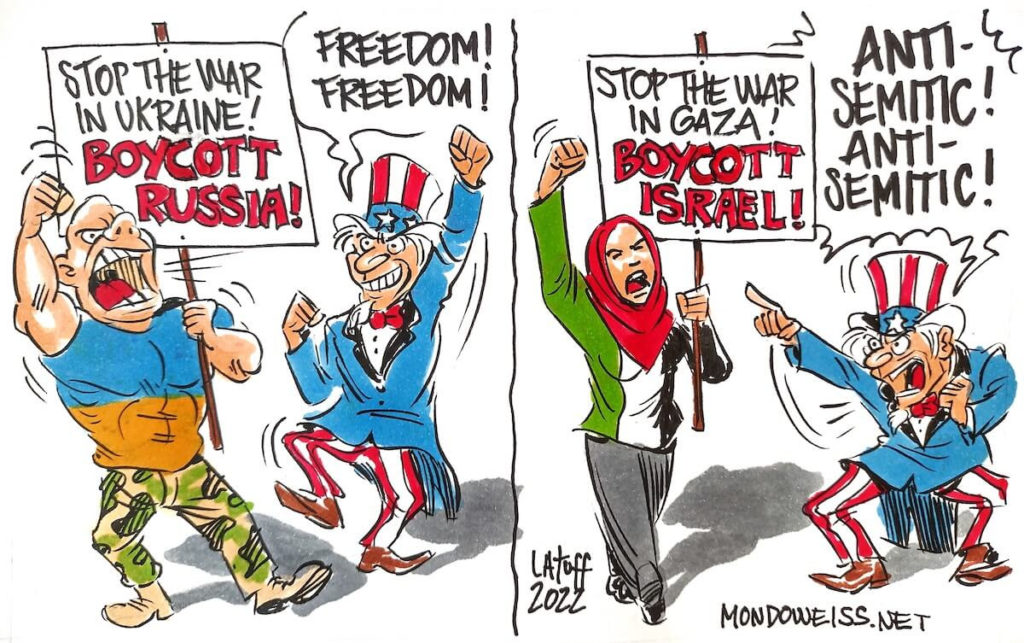

Laurie Calhoun joins Dennis J. Bernstein on Flashpoints, a program of KPFA 94.1, Pacifica Radio, to discuss War Criminals Past and Present. The discussion begins about 34 minutes into the hour-long program, which was recorded on March 24, 2022.

KFPA 94.1 Flashpoints, Pacifica Radio: “War Criminals Past and Present”